Rising fiscal risks in the United States are heightening the volatility in US treasuries and the dollar, and as such, a flexible approach to fixed income is favoured to diversify away from US assets, according to a new report.

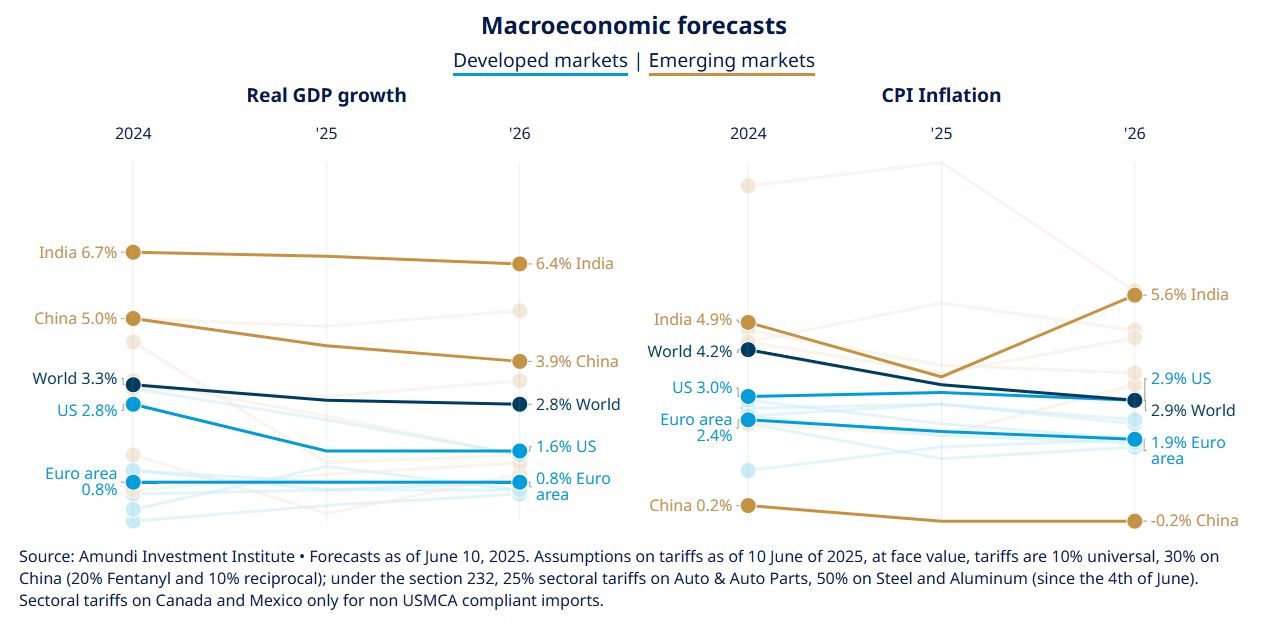

The US economy is expected to decelerate below its potential, to 1.6% in 2025-2026, from nearly 3% in 2023-24, as greater uncertainty and tariffs weaken demand, Paris-based asset manager Amundi says in its 2025 Mid-Year Global Investment Outlook.

Such a scenario is likely to lead to economic losses and a temporary resurgence in inflation, which in turn could hit corporate margins.

Fiscal measures and deregulation should provide only limited relief, the firm says, adding that the US deficit could near 6.5% in 2025. It expects the Federal Reserve to cut policy rates three times in the second half, to reach 3.50% by end of 2025.

“Government bond markets are rattled by the threat of higher debt and rising inflation fears, keeping volatility high. Investors are likely to demand greater compensation for long-dated bonds, making yields appealing. The name of the game will be diversifying away from the US and into European and emerging market bonds,” says Vincent Mortier, Amundi’s group chief investment officer.

“In credit, we favour high-quality credit and prefer European over US investment-grade,” the report says. “We are neutral on high-yield as spreads may rise towards the end of the year. In terms of sectors, we like financials and subordinated credit. Bank subordinated debt could prove one of the most interesting segments.”

Amundi believes emerging markets ( EM ) will benefit from an overall positive growth and inflation path, easing monetary policies, and a growing middle class. Fading US economic exceptionalism and a weakening US dollar will also enhance the attractiveness of EM assets.

“While the pending sectoral tariffs present risks, they also fuel the development of localized supply chains that benefit EM. India and Asean emerge as key beneficiaries of these structural shifts and remain major drivers of growth,” the report says. It expects GDP growth of 6.6% this year and 6.4% in 2026 for India, and 4.3% and 3.9% for China.